Circular Fashion: the results of the Circular Fashion Index

The circular economy represents an approach to production and consumption based on sharing, reusing, repairing, reconditioning and recycling existing materials and products, with the aim of extending their life cycle as much as possible.

The circular economic model helps minimise waste and is an answer to global challenges such as climate change, biodiversity loss, waste and pollution based on three principles:

- Eliminate waste and pollution

- Extend the useful life of materials and products

- Regenerate natural resources

The transition to a circular economy is a valid and effective means of mitigating the environmental impacts of the fashion industry. According to the Ellen MacArthur Foundation, in fact, the implementation of circular business models (rental, resale, repair and remaking) would save approximately 336 million tonnes of gas emissions by 2030, i.e. 32% of the total abatement required for the textile industry to meet the Paris Agreement targets.

However, the adoption of circular economy practices by companies in the fashion industry is still uncommon. In fact, Kearney recently published a new edition of the Circular Fashion Index (CFX), a ranking that assesses the circularity performance of major fashion brands, in which it is clear that the fashion industry still has a lot of work to do in the process of transitioning to the circular economy.

The Circular Fashion Index data: which brands are the most circular?

The average score of the Circular Fashion Index (CFX) 2023, among the 200 fashion brands analysed, stood at only 2.97 out of 10, a similar result to that achieved in 2022.

The companies with the highest scores were Patagonia, Levi's and The North Face, with values of 8.65, 8.30 and 7.90 respectively. While Patagonia and Levi's managed to improve on their already high score from 2022, The North Face's score decreased slightly.

Then there are companies that have improved significantly since last year, such as:

- Athleta: in September 2022, Athleta launched its first resale platform, called 'Always Athleta'. This is a resale programme where customers can purchase a wide range of used Athleta products at up to 90 per cent off the estimated selling price.

- Timberland: during 2022, Timberland has strengthened its partnership with ReCircled to extend its take-back service for used Timberland products globally, both through physical shops and by shipping. The aim is to repair these products and resell them on its dedicated 're-commerce' platform. If the products cannot be repaired, their parts are converted into inputs to create new products, thus avoiding their disposal in landfills.

- Jimmy Choo: In October 2022, the company partnered with The RealReal to promote the second-hand market and strengthen its commitment to circularity. Customers who resell their products through this platform are offered an exclusive experience in Jimmy Choo boutiques.

In addition, among the new brands added since last year's edition, those with the highest scores are: Madewell (sixth place), Mammut, GANNI and Golden Goose:

- Madewell scored especially well on second-hand clothing, thanks to its Madewell Forever programme and take-back programmes that prevent old clothes from ending up in landfills.

- Mammut scored well for the high percentage of recycled materials used, communication, care instructions and repair services.

- GANNI experimented with repair and customisation pop-ups in selected shops in Denmark, the UK and the US. In addition, it collaborated with Reflaunt, a resale service provider, and UK rental platforms HURR and Rotaro to re-launch rental initiatives outside Denmark.

- Golden Goose launched a new shop concept called Forward Store, in which the brand promotes circular repair initiatives (in-store and soon online repair services), remanufacturing, resale (collection of second-hand Golden Goose shoes) and recycling (delivery services for old shoes).

Circular Fashion Index results on country of origin

Brands are also analysed by country of origin and sector within the Circular Fashion Index.

In terms of country of origin, more than 80 per cent of the 200 brands analysed in the Circular Fashion Index 2023 come from the United States, France, Italy, India, Germany and the United Kingdom. With the exception of Indian brands, which score significantly lower than the rest of the panel, the results of the other countries are fairly aligned, with average scores between 2.6 and 3.4, confirming that there is much to be done around the world.

French brands have the highest average score, followed by American and German brands.

Although France has the highest average CFX score, no French brands are in the top 10. However, 50% of French brands are in the top quartile, leading the way in the percentage of recycled fabrics.

The United States has five brands in the top 10: Patagonia, Levi's, The North Face, Madewell and Coach. The other brands are evenly distributed among the various quartiles. American brands stand out for their clothing rental services.

As far as Germany is concerned, the German company Esprit is in the top 10, while Adidas, Hugo Boss and C&A are in the top quartile. The other brands are evenly distributed between the quartiles.

The highest scoring Italian brands are OVS (in 4th place) and Gucci (in 5th place), followed by Moncler in the top quartile. Italian brands seem to focus more on the use of recycled fabrics, while rental and second-hand solutions are less popular.

Four British brands ranked in the top quartile (Burberry, Alexander McQueen, River Island and Barbour), due to their strong commitment to end-of-life solutions for used clothing.

Indian brands scored low in the assessment. All brands are in the lower half of the ranking, showing below-average scores in all categories, except for product care education, where Indian brands score above the global average.

Among the other 14 countries with 39 brands analysed, Canada scored highest due to Lululemon Athletica's position in the top 10, followed by Sweden (with all four brands in the top quartile) and Switzerland.

The Circular Fashion Index results on the reference sectors

As far as the sector is concerned, the 200 brands analysed are evenly distributed across the six reference categories (Mass Market, Premium/Accessible Luxury, Luxury, Sport/Outdoor, Fast Fashion, Underwear/Lingerie).

As in the case of the country results, the different categories are also aligned with average scores between 2.5 and 3.5. In particular, the Sport/Outdoor brands obtain the highest average score, while Fast Fashion registers the lowest score.

In 2023, thanks to improved solutions for the collection of used articles and the management of their end-of-life, the Sport/Outdoor category is confirmed as the best performing.

This is followed by the mass market, with brands scoring highest on detailed and thorough product care instructions.

The luxury segment ranks slightly above average due to the wide availability of repair services, while the premium/accessible luxury category scores slightly below average. However, it demonstrates a circularity-oriented attitude, with the main investments in second-hand sales and rental services.

Due to the nature of the products, fast fashion and underwear/lingerie scored lowest.

Conclusions

The analysis of Kearney's Circular Fashion Index clearly shows that several circular fashion solutions exist, however, it is evident that fashion brands still implement them in a limited way. Out of a total of 200 brands analysed, only 19 score at least 5 out of 10 in the index, and only the top three achieve a score higher than 7 out of 10.

Furthermore, many companies have not yet implemented any circularity actions, due to the lack of a clear sustainability strategy, which is crucial when choosing which circular business model to implement.

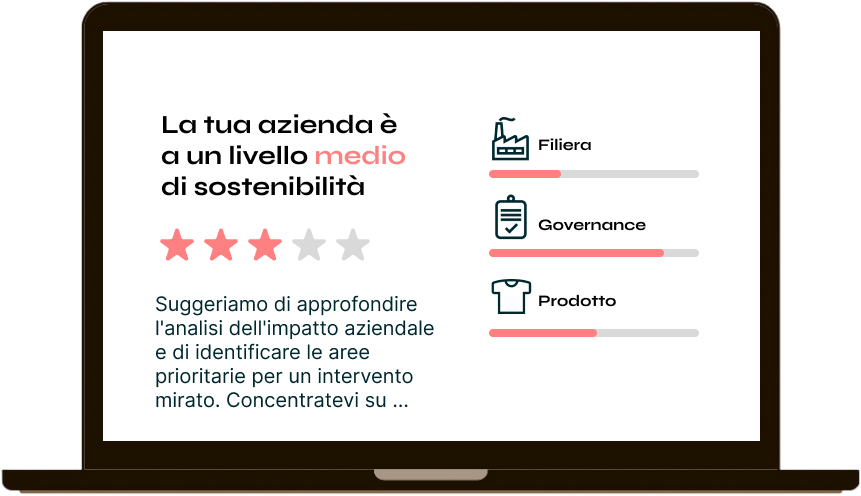

For this reason, Cikis supports companies in defining an ad-hoc sustainability strategy, with the aim of facilitating the transition of companies in the textile and fashion sector towards more circularity.

Get articles like this and the latest updates on sustainable fashion automatically!